| What is a proforma invoice? When and why to use | 您所在的位置:网站首页 › invoice proforma › What is a proforma invoice? When and why to use |

What is a proforma invoice? When and why to use

|

There are times when a business needs a record of an order before the sale has been processed and goods or services delivered. A proforma invoice serves this purpose. But what is a proforma invoice? This article will cover what a proforma invoice is, plus when and how to use one. Get free invoice templates from Wise 📝This article will cover: What is a proforma invoice?What is a proforma invoice used for?Proforma invoice detailsProforma invoice exampleGet paid from overseas fast and easy with Wise What is a proforma invoice? Proforma invoice definitionA proforma invoice is a document provided before or with a shipment of goods. It describes the items and terms of sale, but does not serve the function of a real invoice. It can act as an estimate or quotation for the customer – but not the final bill for payment.¹ What is the difference between a proforma invoice and an invoice?An invoice is a document that specifies any products sold or services provided to a customer for a particular period. It acts as a notification that the customer should pay. A proforma invoice is usually issued before the sale takes place. It is commonly used in export sales, where payment is not yet required. Proforma invoices provide an estimate or quotation for goods or services before they are shipped or provided but only once the customer has demonstrated commitment to a specific price. It does not mean the invoice is due for payment. Proforma invoices cannot be used to request or make payment. A full invoice is needed before the buyer makes payment.

A proforma invoice is often issued by businesses in the international import and export industry. Import taxes and dutiesIf a final invoice is not available, the seller can provide a proforma invoice for customs use. Officials can use this to determine the US import taxes and duties due. This could include any shipments from international suppliers, in the UK or Europe for example, into the US. For example, if you are buying a large batch of materials for your business from overseas, you can usually get your supplier to send the proforma invoice before the delivery. You can then let US Customs and Border Protection (CBP) or your courier know the details beforehand, and pay the charges before the goods arrive in the US. This can save you time spent waiting for US customs. CustomsThe proforma invoice can also be used for US customs clearance. US customs rules for importing goods into the US state: “If no invoice or bill is available, a proforma invoice must be filed, and must contain sufficient information to determine admissibility, classification, and the amount of duties due.” The company must produce the full commercial invoice within 120 days.² Setting clear expectations for customersA proforma invoice can also help the purchaser decide whether to go ahead with the order. It can act like a quotation for consideration. They will also not be hit with any unexpected fees once the invoice arrives, as the proforma invoice will have already given them an estimate. 💡 Paying international shipping and invoices? Find out how Wise Business can save you money.

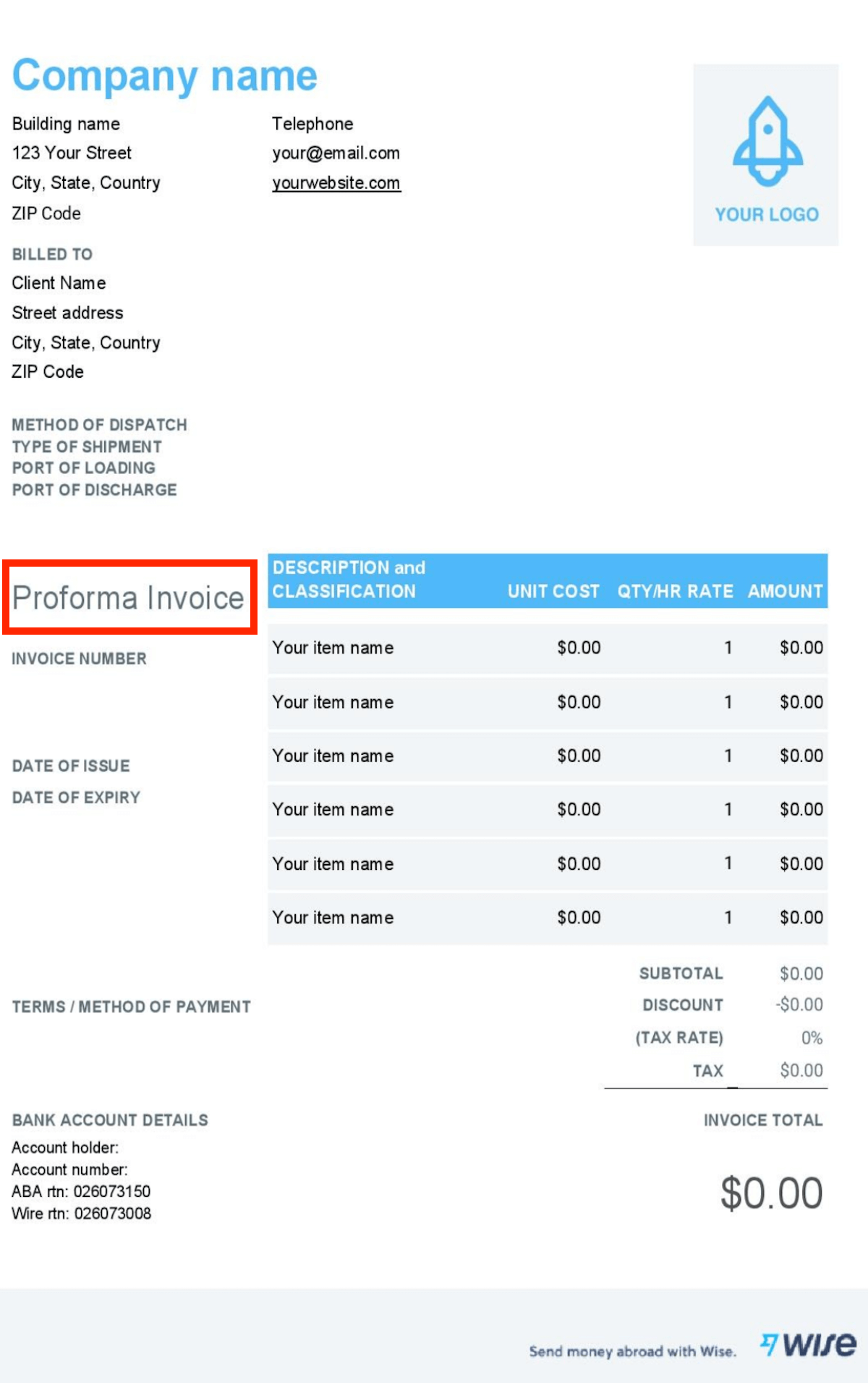

No formal guidelines dictate the exact presentation or format of a proforma invoice. However, it should include some specific pieces of information. This is especially important when used for customs clearance. Proforma invoices should contain:Date, and expiration date, of the proforma invoice.Company and contact details for the seller and the buyer.Seller's invoice number.Details and quantity of products (for customs, this should include country of origin and the product classification).Shipping details (including method of dispatch, port of loading, and discharge).Payment terms and estimated total due. Proforma invoice template and exampleThere is no fixed standard for proforma invoices. Following a template or example can be helpful to ensure you include all the relevant information. If they are required for customs, missing information can lead to delays. Wise provides several templates for invoices in different formats. The following adapted example shows a typical proforma invoice:

If you have international customers, you can save money with Wise Business. Wise offers a multi-currency business account, allowing you to get paid in different currencies. You can also transfer and convert your money when it suits you, all in one place, at the real mid-market rate. You can benefit from having up to 10 local bank account details. This means you can have a UK account number and sort code, for example, even as a US citizen. Customers can pay in their local currency, which can help you get paid faster. Create a Wise Business account for free Wise Business also provides downloadable free invoice templates to make life easier. So next time someone asks 'What is a proforma invoice?', you can show them your own example. Registering with Wise Business is free, and you can get support around the clock. 💡 For all you need to know about invoices, don't forget to read and bookmark the ultimate guide to invoicing from Wise!

Sources: Pro Forma Invoice | Definition of Pro Forma Invoice Entries Without Proper Commercial InvoicesAll sources checked 15 October 2021. This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication. The information in this publication does not constitute legal, tax or other professional advice from Wise Payments Limited or its affiliates. Prior results do not guarantee a similar outcome. We make no representations, warranties or guarantees, whether express or implied, that the content in the publication is accurate, complete or up to date. |

【本文地址】